THIS CONTENT IS BROUGHT TO YOU BY Fridtjof Nansen Institute - READ MORE

Russia could lose its big chance in the global gas market

A new report shows that it's not certain the country will become a major power in liquefied natural gas.

Russia has long aimed to become a major power in liquefied natural gas (LNG).

But Western sanctions are now putting that ambition at serious risk, according to a new report from the Fridtjof Nansen Institute (FNI).

“Russia has low production costs and vast gas reserves, but without access to technology, ships and markets, there’s little they can do,” says Arild Moe, a researcher at FNI.

From rapid growth to a standstill

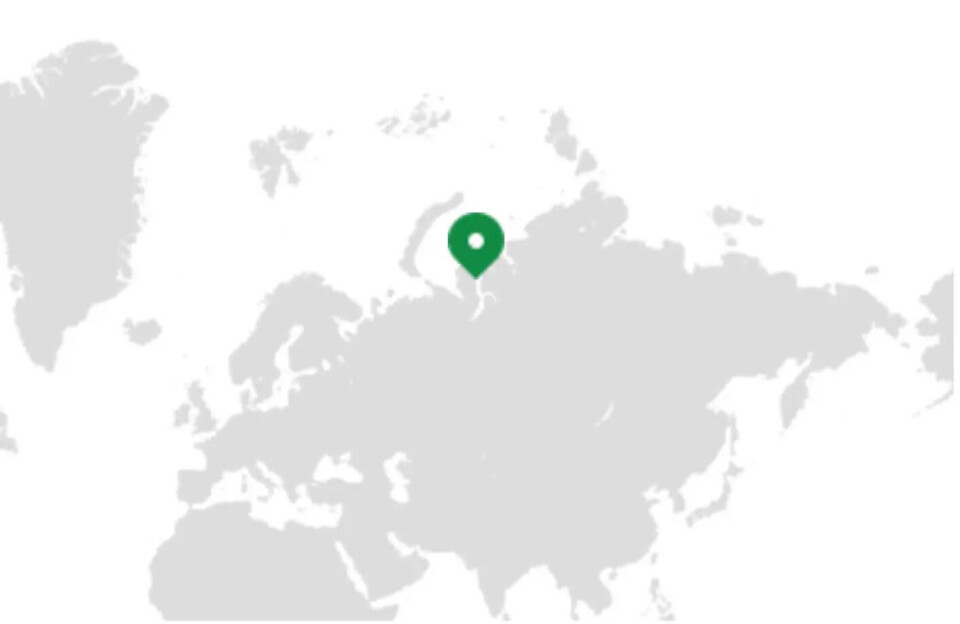

Russia’s LNG expansion gathered pace when Novatek launched the Yamal LNG project in 2017.

Yamal LNG is a Russian facility on the Yamal Peninsula that produces liquefied natural gas for export to the glocal market.

Novatek is Russia’s second-largest producer of LNG, after state-owned Gazprom.

The project became a rare Russian success story: Completed on time, within budget, and with major exports to both Europe and Asia.

Since then, Moscow had planned a series of new LNG projects in the Arctic. But those plans have run into a wall. After the invasion of Ukraine in 2022, Arctic LNG-2 and several other projects were hit by sweeping US and EU sanctions.

Losing the global window

“Arctic LNG-2 has started production technically, but the gas cannot be sold. They also face shortages of specialised ships and equipment. Without a change in the sanctions regime, the project could effectively grind to a halt,” says Moe.

At the same time, new LNG projects are emerging in the US, Qatar, and parts of Africa, all set to enter the market within the next five years. That could make competition much tougher.

“Russia had a window of opportunity, but it's closing fast. Even if sanctions were lifted, many of the most attractive markets would already be taken,” says Moe.

China’s role remains uncertain

Russia has great expectations of China as an investor and buyer of LNG.

But Beijing has so far been cautious about committing significant funds.

“China is interested in Arctic resources, but it will not invest heavily just to support Russia politically. Its approach remains pragmatic,” says Moe.

Rising risks

The report concludes that all long-term investment in Russia’s energy sector now comes with high risk. Projects are delayed, costs are rising, and market prospects are increasingly uncertain.

“On paper, Russia could double LNG output by 2040. In practice, the next decade could bring no new exports at all,” says Moe.

The development also has broader implications.

The EU has decided to phase out imports of Russian LNG by 2027, a move that could reshape global gas flows.

As Russia struggles to expand its export capacity, Europe will turn increasingly to other suppliers, including the US, Qatar, and Norway.

Reference:

Henderson, J. & Moe, A. The Outlook for Russian LNG, FNI Report 1/2025, 2025.

This content is paid for and presented by Fridtjof Nansen Institute

This content is created by Fridtjof Nansen Institute's communication staff, who use this platform to communicate science and share results from research with the public. The Fridtjof Nansen Institute is one of more than 80 owners of ScienceNorway.no. Read more.

More content from Fridtjof Nansen Institute:

-

“It's been a long time since we've seen so many positive developments in such a short period. We may indeed be entering a turning point for nature”

-

Russia pushes for a fossil economy. Can China stop them?

-

What does China aim to gain in the Arctic?

-

Where do the metals in your electric car come from?

-

Power struggle in the Arctic Council: Greenland demands a leading role

-

War in the Arctic? Researchers debunk three myths about the High North