THIS CONTENT IS BROUGHT TO YOU BY the Norwegian University of Life Sciences (NMBU) - read more

Rising housing costs fuel inequality in Norway

In urban areas like Oslo and Viken, many spend more than 30 per cent of their income on housing, highlighting a serious affordability issue.

Despite its strong economy, Norway is grappling with a growing housing divide.

A new report reveals that housing is becoming increasingly unaffordable for vulnerable groups, such as students, immigrants, and low-income renters.

The report is part of the EU research project Reducing Housing Inequalities (ReHousIn), which explores housing challenges across nine European countries, including Norway.

Soaring housing costs

While most households in Norway can manage their housing costs, vulnerable groups face increasingly unaffordable rent that eats up more than 30 per cent of their disposable income.

This 'housing cost overburden' is a key indicator used by researchers to understand the severity of housing price crises. When housing costs exceed 30 per cent of income, it is a clear sign that people’s finances are being stretched too thin.

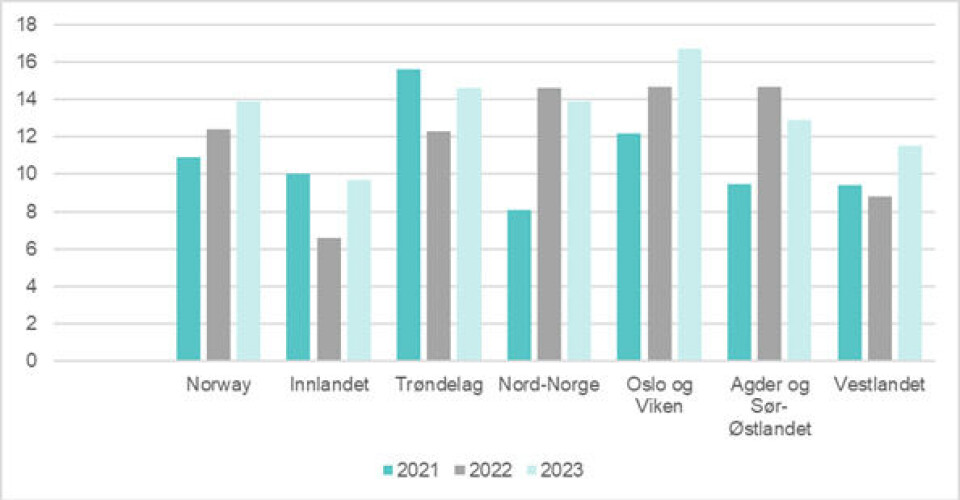

Recent data shows a sharp increase in the housing cost overburden rate in recent years, especially in urban areas such as Oslo and Viken.

Urban researcher Rebecca Cavicchia explains that this trend points to a housing market that is becoming increasingly difficult to navigate for large sections of society.

“Without targeted policy interventions, these inequalities are likely to deepen,” she warns.

Decline in homeownership

Homeownership in Norway has been steadily declining since 2003, dropping from 83 per cent to 79 per cent. While owning a home remains the norm, rising housing prices – especially in cities – are pushing more people to the rental market.

This trend is not unique to Norway.

In the UK, homeownership has fallen in recent years due to rising housing costs and a shift toward private rentals.

In France, homeownership has plateaued at 58 per cent since 2013, as high real estate prices create financial barriers for younger generations.

Spain, too, has seen a shift toward renting since the 2008 financial crisis.

The findings highlight the need to rethink the regulation of Norway's rental market. In comparison to the majority of other countries included in the study, regulations in Norway offer weak protection and stability to tenants.

“This trend across multiple European countries underscores a structural shift in housing markets, where rising costs, financial constraints, and changing economic conditions are making homeownership increasingly unattainable for younger and lower-income households,” explains Cavicchia.

The dream of owning a home is becoming more elusive for younger generations and lower-income households.

Government funding cuts make things worse

The report also highlights a significant decline in public investment in housing. Since 1995, government expenditure on housing has remained below one per cent of total public spending, while investments in public and community housing has steadily decreased.

“The reduced government commitment to housing investment has contributed to a shrinking supply of affordable housing,” says Roberta Cucca.

She is an urban sociologist at NMBU.

“This lack of public support disproportionately affects lower-income groups who can’t rely on social and subsidised housing options,” she says.

Energy challenges and the green transition

Norway’s push for a greener, more sustainable future has seen a 75 per cent reduction in CO₂ emissions from the building sector since 1970.

Rising electricity prices and global energy instability, however, have made it even harder for low-income households to keep up.

“The push for energy-retrofitted housing must go hand-in-hand with affordable housing. Otherwise, we risk a situation where sustainable urban policies benefit wealthier homeowners while excluding renters and low-income groups,” says Cucca.

What needs to be done?

The researchers call for immediate policy reforms to address these growing housing inequalities. Their recommendations include:

- Expand public and affordable housing to counteract the growing reliance on the private rental market.

- Amend rental regulations to ensure stability, regulate short-term rentals, and protect vulnerable groups from excessive cost burdens.

- Integration of housing policies and green transition initiatives to ensure fair access to sustainable housing solutions.

- Address regional disparities by increasing support for affordable housing in high-demand urban areas.

Cucca stresses the importance of aligning urban green policies with affordable housing initiatives.

"Policymakers must ensure that good-quality housing remains accessible for all, particularly in urban centres where affordability is under pressure. This is an important aim of the new European Affordable Housing Plan, which will be soon defined by the EU. It's something we're closely monitoring through this research," she says.

Reference:

National report on housing inequalities – Norway | ReHousIn

More content from NMBU:

-

Shopping centres contribute to better health and quality of life

-

We're eating more cashew nuts – and the consequences are serious

-

Do young people with immigrant parents have better health?

-

Who’s picking your strawberries this summer?

-

Can coffee grounds and eggshells be turned into fuel?

-

Researchers warn: Climate change in African mountains has a greater impact than previously thought