This article was produced and financed by BI Norwegian Business School

Preparing for a post-oil era

Norway has developed three global industries that can succeed oil production: the offshore, maritime and seafood industries.

Denne artikkelen er over ti år gammel og kan inneholde utdatert informasjon.

Nations and regions compete to become the most attractive locations for knowledge-based businesses. Norway, an oil-producing nation, has prospered for a long time and managed to weather the turbulence caused by the international financial crisis.

Even though new, major oil discoveries have recently been made, the oil revenues generated will eventually cease. Whatever will Norway do to make a living?

Norway is indeed a beautiful country, but is not exactly the hub of the world. This oil nation also has one of the highest cost levels in the world.

How can Norwegian companies assert themselves in international competition? How can Norwegian regions become attractive to international businesses in competition with both Asia and the rest of the world?

“Norway’s future business and industry sectors must be knowledge-based, change-driven, globally oriented and environmentally robust,” says Professor Torger Reve at BI Norwegian Business School.

The search for winners

Reve has headed the research project A Research Based Norway at BI Norwegian Business School. A team of 17 researchers and the same number of student assistants have conducted a strategic analysis of 13 of Norway’s most important business and industry sectors.

The sectors surveyed account for 80 percent of value creation and 70 percent of employment in Norwegian business and industry.

BI Professor Reve has developed a model for measuring the attractiveness of the sectors along the following six dimensions:

-

Cluster attractiveness is measured through the critical mass of companies located within a business sector or a continuous business-based knowledge field.

-

Education attractiveness means that we have a school and university system that trains a sufficient number of candidates with the expertise and qualities required by business and industry.

-

Talent attractiveness means that businesses are able to attract a more than proportionate share of the talents available in the labour market. Quality is more important than quantity. It is important for businesses to succeed in attracting qualified labour from abroad.

-

Research and innovation attractiveness indicate to what extent Norway asserts itself at the top of the class within the knowledge field and global industries where we are a significant force internationally.

-

Ownership attractiveness tells us how accomplished a company is in attracting competent owners in all phases of the industrial development, from the high-risk early phase to the commercial harvesting phase.

- Environmental attractiveness means that companies are able to meet the new environmental and climate requirements, e.g. as regards CO2 emissions. We are talking about companies being environmentally robust.

In addition to achieving a high score on the six dimensions surveyed, companies must be able to exploit their attractiveness through collaboration and competition with other companies. They must create their own knowledge dynamics.

The study’s findings are presented in a book written by Torger Reve and Associate Professor Amir Sasson at BI Norwegian Business School.

Three global knowledge hubs

“Norway’s riches seem inextricably linked to water and the sea. Herein lies our most important competitive edge, from hydropower to subsea technology,” Reve and Sasson point out.

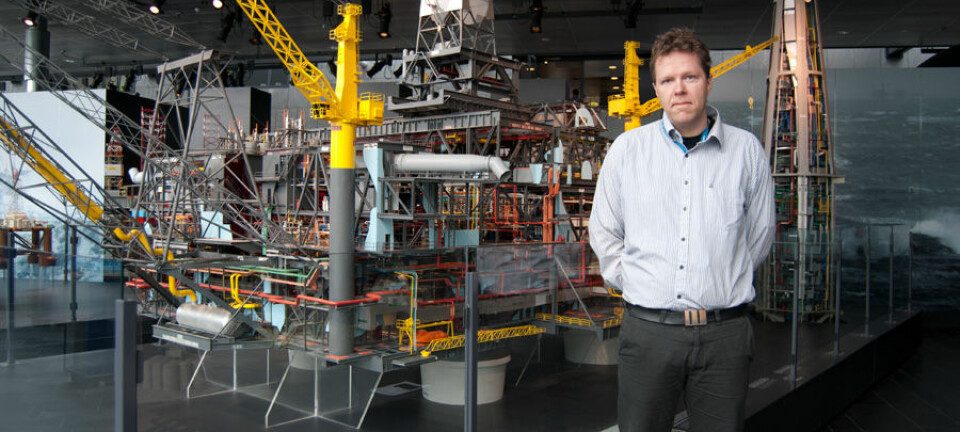

The study identifies three global knowledge hubs that represent Norway’s most international industries: oil and gas, the maritime industry and the seafood industry to some extent. The oil and gas industry and the maritime sector today overlap so much that they are in the process of merging into one global knowledge hub: Offshore.

Norway’s global winning industry is the offshore sector. This sector developed in the interface between offshore hydrocarbons, maritime technology and insatiable European energy markets. This is a sector that upholds major parts of our industrial knowledge capital. There is good reason to believe that precisely the offshore industry will also spin off new industry in renewable energy and in the exploitation of other natural resources linked to the sea and seabed.

The seafood industry is a smaller and more specialised industry cluster, and is critically dependent on salmon farming. This industry is characterised by a highly cyclical market character, nearly approaching the level of the shipping industry.

“International high-risk industries with substantial market fluctuations are in some respects a Norwegian business discipline. We like to take risks and we like to win,” say Reve and Sasson.

Finance – better than its reputation

In addition to the three global industries, the BI researchers have identified three important complementary knowledge industries: the finance industry, the ICT industry and knowledge-based services with Det norske Veritas as a flagship of sorts.

“These industries, however, are only international in the contexts in which they are linked to the three superclusters offshore, maritime and seafood,” according to the researchers.

The finance industry is one of Norway’s most profitable and has the greatest potential for acquiring international strength. Like other service industries, finance is international in areas where customers are the world’s leading companies.

Norwegian banks are world leaders in maritime financing. When an industry is so far ahead in one sector, it should be able to assert itself further, for example in the oil and gas or seafood industries.

The ones that didn’t make it

Health and biotechnology represent one of the major global growth sectors in the years to come.

The researchers question whether the Norwegian biotech companies will manage when they do not have any market-related or capital-related impetus from other industries in Norway.

“We will be developing new, advanced knowledge companies for foreign owners just like we’ve done with IT and pharmaceuticals,” Reve and Sasson predict.

Tourism at the bottom end of the scale

Renewable energy does not stand much of a chance either in international competition.

“Traditional Norwegian hydropower and possibly offshore windmills may perhaps manage,” Reve believes. In his opinion, solar energy or onshore windmills will probably not grow to any great extent in Norway because they lack a common knowledge base on which to build.

The major domestic market industries such as the wholesale and retail trade, building, construction and real estate seem to remain at home, in part because the domestic market has substantial purchasing power and profitability and partly because they have negligible international market expertise.

At the very bottom of the list of attractive Norwegian industries is tourism. This sector has very low profitability. The formal level of expertise in the tourism industry is also low.

“It is a paradox that this is an industry in which Norwegian authorities have invested substantially,” says Torger Reve.